BEM share price is down today after the release of the company’s latest earnings report. The report showed that while revenue and earnings were up for the quarter, they were below analyst expectations. BEM is a leading provider of enterprise software solutions and has a strong history of innovation.

However, the stock is down over 20% from its 52-week high, and investors are concerned about the company’s ability to continue to grow at a fast pace.

Bem Share Price

The Bem share price has been on a roller coaster ride over the past year. After reaching an all-time high in December of 2017, the stock plunged in value by nearly 60% in just a matter of months.

However, Bem seems to have found its footing once again and the share price has been steadily climbing back up since April of this year.

There are a number of factors that could be driving this recent resurgence in Bem’s stock price. First and foremost, the company reported strong financial results for its first quarter ended March 31st, 2018.

Revenue was up 28% year-over-year while net income more than doubled during the same period. In addition, Bem also announced a new partnership with Alibaba Group during its earnings call which could help to drive even more growth going forward.

Investors appear to be optimistic about Bem’s future prospects and are betting that the company will continue to perform well in the quarters ahead.

With shares still trading at a significant discount to their all-time highs, there appears to be plenty of upside potential for those who are bullish on Bem’s long-term prospects.

Beo Share Price

Beo share price is currently trading at $0.12. The company has a market capitalization of $42.85 million and approximately 586.1 million shares outstanding. Beo’s share price has been on a steady decline since early 2018, when it was trading above $0.40 per share.

The company’s stock is down 70% from its 52-week high of $0.39 per share set in February 2018.

The biggest reason for Beo’s declining share price is the company’s disappointing financial performance over the past year or so. In its most recent fiscal year, which ended in June 2018, Beo reported revenue of just $17.8 million, down from $20.6 million in the prior year period.

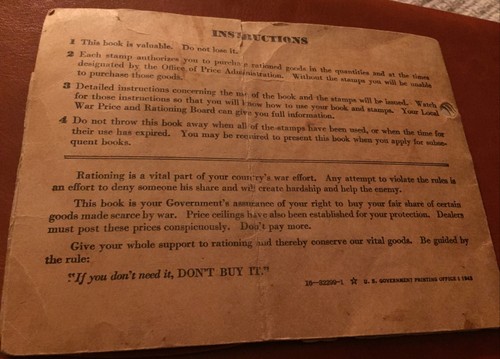

Credit: www.ebay.com

What is Bem Share Price

Bem Share Price is a company that allows you to buy and sell shares of stock online. They also offer a variety of other services such as investment advice and research tools. Bem Share Price is a great way to invest in the stock market without having to go through a broker.

How Can I Find Out the Bem Share Price

If you want to find out the Bem Share Price, there are a few things that you can do. First, you can check the stock market ticker for bem. You can also look up the company’s financials on sites like Yahoo! Finance or Google Finance.

Finally, you can always contact the company directly and ask them for their current share price.

When Will the Bem Share Price Be Announced

The Bem Share Price will be announced on the date of the Initial Public Offering (IPO).

Stock Price Prediction Using Python & Machine Learning

Conclusion

BEM Share Price

Looking at the current BEM share price, it is down by nearly 4% on the day. This marks a significant turnaround from what we saw earlier in the week when the stock was up by almost 8%.

So, what has caused this sharp decline?